Foreclosure again is subject to charges.Īpply for an Axis Bank New Car Loan and make your dream of owning a car come true.īroadly there are three ways you can apply: paying all the outstanding dues of your Car Loan, is also possible by submitting a foreclosure request to the bank. Part-prepayments of Car Loan is possible but subject to part payment charges. Hence, always make it a point to repay the Car LoanĪnd in case if you partially prepay the Car Loan… Note that persistent skipping inflicts the risk of default, and in such a case, your car hypothecated to the bank as collateral for the Car Loan, may get seized. As a result of skipping the EMI, the tenure of the loan would increase Yet, in case of insufficient balance or any other reason you skip your EMI, the bank will caution you and may charge a late payment penalty. Hence, in the interest of your financial wellbeing, borrow wisely and as far as possible do not skip your Remember, skipping EMIs does not reflect well on your creditworthiness and could impact your credit score. Opting for SI or NACH/ECS mode is preferable as it is faster and less prone to errors than PDCs. Post-Dated Cheques for your Car Loan EMI is also an option if you do not hold an account with Axis Bank and for non-ECS locations.National Automated Clearing House (NACH)/ECS mandate can be used if you do not have an account with Axis Bank and would like your EMIs to be debited automatically at the end of the monthly cycle.Your EMI will be automatically debited from the account you specify.

Standing Instructions (SI) can be used if you have a savings account, salary account, or current account with Axis Bank.This is because EMIs are computed on a reducingīalance method, which works in your favour as a borrower. So, consider opting for longer loan tenure when you avail a Car Loan so that repayments can become comfortable.ĭo note that during the initial months of the Car Loan tenure, you pay more towards interest, and gradually, as you repay the loan, a higher portion is adjusted towards the principal component. Similarly, opting for a longer tenure reduces your EMI and

Higher the interest rate on the loan, higher will be your EMI and vice-versa. Remember, the interest rate and your loan tenure are the vital deciding factors for your loan EMI.

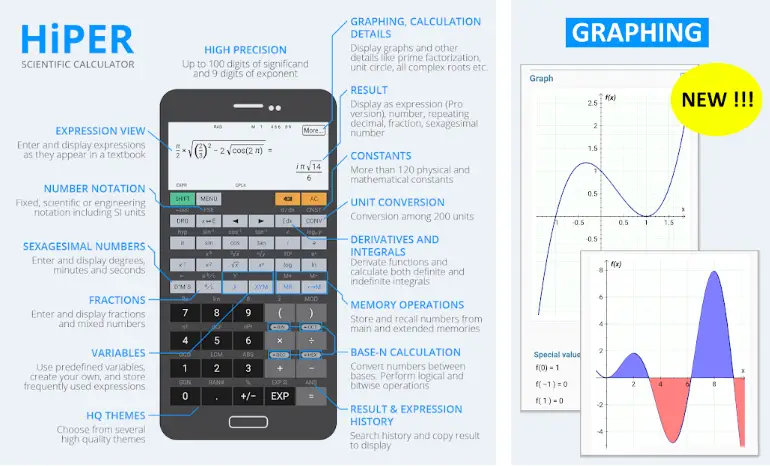

Best financial calculator app manual#

Saves time and energy spent on doing manual calculations.Here are the five benefits of using the EMI calculator: All you got to do is use the slider to enter the loan amount,Ĭar loan interest rate, and the tenure of your loan (in months). Mathematically, EMI is calculated as under:Īxis Bank’s Car Loan EMI calculator is a great online tool that provides you with the answer in a split second and enables you to understand how much will be your EMI outgo. Your loan, and it is to be repaid over the tenure of the loan on a monthly basis. The EMI, usually, remains fixed for the entire tenure of

Therefore, EMI = principal amount + interest paid on the Car Loan. The Equated Monthly Instalment (or EMI) consists of the principal portion of the loan amount and the interest. So, before you apply for a Car Loan, as a prudent loan planning exercise, make it point to assess how much would be the EMI on your Car Loan. To make the loan repayment comfortable, you have the EMI (Equated Monthly Instalment) facility. The Car Loan is offered even to proprietorship firms, partnership firms, companies, trusts and societies. You can get a pre-approved car loan, depending on your income and credit score, but subject to maximum loan tenure and the loan amount.Īxis Bank offers Car Loans at an attractive rate of interest, low processing fee, a repayment tenure of upto 7 years, and higher loan-to-value ratio (100% on-road price funding on certain You can simply avail a new Car Loan and drive in your dream car sooner. You don’t need to be wealthy enough or save a fair amount of money to buy your first car, unlike a couple of decades ago. Today, buying a dream car is almost within your reach irrespective whether you are salaried or self-employed.

0 kommentar(er)

0 kommentar(er)